Summary

The financial policy is representative of the general policy of the state. Through taxation, governments can exercise biopower[1] and maintain a social contract with their citizens. However, the Tunisian state budget suffers from a chronic deficit as it is growing between 3-4%[2], according to Ministry of Finances figures. This situation has considerably weakened the position and social role of the state. There are several causes of this deficit but this policy brief focuses on one; the tax system. This policy brief has three parts; firstly, an examination of the tax system’s weaknesses, secondly, a list of necessary procedures and mechanisms to rehabilitate the tax system, and finally, recommendations based on suitable reports and studies.

Introduction

On the eve of Ali Ben Ghedhahem’s revolution, on December 11, 1863, the French consul in Tunisia, Charles de Beauval (1863-1864), sent a telegram to the French Ministry of Foreign Affairs[3]: “Tunisia does not need liberal theories disproportionate to its economy. It just needs to establish a balanced and fair tax system and apply the law”. More than 157 years have passed since then, but every successive Tunisian government since independence has continued to call for reforms to realize this dream of a “fair tax system”. The financial crisis in Tunisia, aggravated in recent years by political instability, is symptomatic of the flawed tax system. The efficiency of all its components has seriously declined which has led to a considerable weakening of social service institutions.

Diagnosis of the dysfunction

After the Revolution of 17-14, the Ministry of Finance initiated a series of meetings to discuss the tax system in Tunisia, as part of the political agreement on administration reform. In partnership with the International Monetary Fund (IMF), this initiative includes the Tunisian Tax System Reform Project[4]. The meetings established a series of approaches to diagnose the tax loopholes in most of the state’s public revenues, especially for declarations and deductions. The flat-rate scheme[5] is one of the key aspects of the project that the ministry has been intending to launch for years.

Complex and multi-level legislation

The tax system suffers from legislative inflation of tax laws and the impact of endless government rulings, decrees, sectoral agreements, and administrative circulars. In addition, articles are included in annual finance laws at the whim of the government, which usually include either exemptions or increases.

In addition to the inclusion of tax as a constitutional right, several major pieces of legislation generally overlap on taxation, such as the Value Added Tax Code (1988), the Personal Income Tax and Corporate Tax Code (1990), the Registration and Stamp Duties Code (1993), the Investment Incentive Code (1993), the Local Tax Code (1997), the Code of Fiscal Rights and Procedures (2000), as well as several other fees imposed on transactions, transport, and insurance. As a result, the legislation is complicated and dispersed in different laws, which prevents the tax system from functioning efficiently. This also facilitates injustice as the system is conducive to tax evasion, such as when certain taxpayers benefit from the flat-rate regime without being eligible for it. This is explained by the absence of sufficient regulatory criteria, concerning the data relating to the activity carried out, which would make it possible to grant it only to the most deserving. It is for this reason that the number of beneficiaries[6] fell from 149,000 users in 1989, to 277,000 in 1999 and 400,000 beneficiaries in 2012. This increase leads to a decrease in the participation rate of members of this scheme (i.e. – flat rate) as shown in the following table:

| Year | 2010 | 2011 | 2012 | 2013 |

| Number of members | 376000 | 388000 | 395000 | 400000 |

| Annual tax contributions (in million dinars) | 29.8 | 16.4 | 23.4 | 22.3 |

| Average annual contribution per individual (in dinar) | 79.2 | 42.2 | 59.2 | 55.7 |

Source: Ministry of Finance, 2014 [7].

As these figures show, most Tunisian companies are joining this scheme. Indeed, these represent about 88% of the entrepreneurship economic landscape including services, commerce and industry. Also, the contribution rate of taxpayers, specifically members of the flat-rate regime, does not exceed 0.2% of the total state tax revenue (4.78% for the real regime)[8]. As for employees’ contributions from the public and private sectors, it represents about 24.6% of the total annual revenue[9]. Compared to the figures in the previous table, and according to a survey conducted by the investigative media Inkyfada[10] , the income tax rate for employees reached around 1,344 dinars in 2014 (compared to 999 dinars in 2012).

Administrative stagnation and lax system controls

In 2019, the number of taxpayers in liberal professions and businesses amounted to 700,000 taxpayers, excluding employees: 549,277 individuals and 143,031 businesses[11]. However, the Tunisian government suffers from a serious shortage of human resources. A report titled “The tax administration in Tunisia: a dysfunctional apparatus”[12] shows that 4,500 agents are responsible for collecting taxes from 700,000 taxpayers. Only 69% are directly responsible for this operation. These agents are distributed among the 241 tax offices across the country.

For tax audit, only 3,400 agents are employed, 48% of whom are directly responsible for the audit process; 450 out of 1,600 agents are responsible for in-depth controls. It should be noted that several overlapping reports concerning the negative impact of limited human resources on tax collection.

This is evidenced, for example, by the cash flow deficit which has slowed down the declarations of debtors and their inclusion. Technically and logistically, tax administrations, such as tax control centers, lack equipment and supplies e.g. a single car for 16 agents and 1 computer for 3 employees. In addition to being concentrated in the capital, tax agent training is ineffective and is limited to technical aspects to the detriment of human aspects, such as the psychological factors of pressure, stress, lack of protection during inspections, and audits.

The tax information system lacks equipment and logistical capacity. Also, several overlapping government reports, for example, reports 24 and 32[13] by the Court of Auditors and teams from the Ministry of Finance, in addition to the reports provided by Oxfam[14] and Al Bawsala[15], address the failure of the information system as well as the applications Rafik, Sadek, Aaref, Adab and Jad. For example, report 30 of the Court of Auditors reveals that the agents of a tax office were unable to detect certain inconsistencies in declarations of transactions worth 1.88 million dinars because of the absence of coordination between the teams of Rafik and Sadek[16].

A weak culture of citizenship and a total lack of transparency

The authors of “The banished in the social history of Tunisia” presents taxes, in particular financial pressure, as a cause of social movements in Tunisia. The authors of the book deal with the prevailing social mentality, especially during French colonization, and the links between patriotism and resistance with the rebellion against the ruling power, the refusal to pay taxes, and tax evasion. After the last of the last French troops evacuated, two factions were quickly formed: supporters of Habib Bourguiba and supporters of Salah Ben Youssef. As a result of this split, doubts began to be drawn about the very plausibility of independence and the new regime in place, accusing it of being the deceptive facade of the old authority. This reconsideration has resulted in a proliferation of tax evasion, a weakening of nationalist ideology and a worsening of the periodic instability that manifests itself almost every decade. Lately, the situation has worsened even more with the entrenchment of corruption, besides the fact that a large part of the population perceives tax evasion as a clever and lucrative manoeuvre.

According to a report by the Network for fiscal justice carried out in 2020, the Tunisian tax administration obtained an average of 78/133, which places it in the category “secret with distinction” according to the scale adopted in The report[17]. Also, report 32 of the Court of Auditors, concerning the State debt collection control mission, indicates a delay in the payment of debts due to several factors[18]. Therefore, it is impossible to deduct or lose these royalties. This may suggest that authorities are being more lenient towards some individuals at the expense of others, which will fuel suspicion and encourage tax evasion.

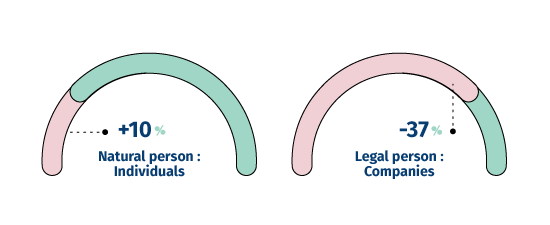

Contribution to tax revenue between 2010 and 2018

Source : Oxfam

Almost nine years have passed since the end of the evaluation sessions initiated by the Ministry of Finance, and despite the monitoring reports of government structures and national and international organizations, successive governments still maintain the status concerning tax reform. Likewise, they continue to act with caution, rebalancing the budget by blindly increasing taxes. This approach consisted in raising taxes on added value and on consumption to compensate for the deficits generated by the tax system, at the expense of citizens. We will examine, based on the reports consulted, the solutions and procedures to apply to the current tax system.

Procedures to rehabilitate the tax system

Simplify and develop legislation

The report of the “Tax System Reform Project (2014)”[19] refers to a set of procedures and recommendations, mainly the preparation of “a unified version of taxation that brings together all tax texts”, to simplify the regulation tax simplified and ensure more practical management. This solution could simultaneously reduce the burden of bureaucracy on citizens and ensure more transparency, which would increase taxpayers’ confidence. In addition, the rates of value-added tax must be reduced to two ratios at most for all sectors to guarantee real tax justice. In addition, it is imperative to regulate and clarify exemptions and privileges. Likewise, the tax legislation needs to be revised in order to simplify the recovery of surpluses.

The fight against tax fraud through the flat-rate regime

According to the report of the “Tax System Reform Project”, the majority of taxpayers benefit from the flat-rate system, without being eligible for it. This is due to the absence of sufficient regulatory criteria concerning data relating to the activity carried out, which would make it possible to grant it only to the most deserving. These taxpayers can be charged with tax evasion until proven guilty. In this sense, the report recommends a re-reading of the texts regulating this regime and proposes a series of recommendations such as limiting the use of the flat-rate regime to a period of three to five years (without renewal) and requiring online registration for provisions and service provision.

Develop an integrated information system

The Ministry of Finance staff has an arsenal of applications and IT systems (Sadiq, Rafiq, Aref, Jad, Adab) and applications launched in February 2021 for customs such as SINDA and Hannibal. However, despite the unification of the Ministry of Finance, coordination between the teams working on these applications remains weak[20]. Based on the partnership agreements between Tunisia and the United States, the Ministry of Finance, within the framework of the First[21] program with USAID, has taken a set of measures to increase the profitability of its fiscal interests, such as the establishment of an intranet, the authorization of the revenue and tax administrations and tax control centers, as well as the training of officers in investigation and audit, in addition to the establishment of a series of computer systems such as dashboards. These measures mark a positive step in the establishment of an egalitarian tax system, provided, however, that they are consolidated by monitoring and political interest:

- The authorities must broadly apply these measures so that all the components of the economic landscape are registered in the electronic systems.

- There is a need to consolidate and secure the electronic registers of tax administrations using Blockchain technology.

- The entire tax system should be strengthened through the use of the efficiency indices recommended in previous reports of the Court of Auditors.

These measures, in addition to the previous ones, make it possible to recognize applicants eligible for the flat-rate system and to oblige others to follow the real regime, which helps to broaden the tax base and consolidate cash resources.

Conclusion

The tax question is one of the most important socio-political drivers in Tunisia’s history and a trigger for social movements. The Ministry of Finance’s project to abolish the flat-rate regime [22] will undoubtedly change the current political landscape, considering the tax differences and the varying opinions of economic actors. Taxation is central to a government’s ability to maintain a social contract with its citizens but it is impossible to adopt a unilateral approach, such as the flat-rate regime, without generalizing other privileges or, on the contrary, withdrawing them altogether. Also, in return for taxes, the state must gain the confidence of citizens by honouring its social contract obligations to taxpayers, such as security, protection, and justice.

Recommendations

- Launch an ongoing awareness campaign on the importance of paying taxes for the maintenance of the democratic political system and a durable and efficient development strategy. The campaign should include political advocacy towards authority, starting with the Executive branch and extending to the Ministry of Finance. This would make the campaign a national strategy on condition of coordinating with the rest of the parties, such as social organizations, components of civil society, the media, all political parties, and institutions to consolidate a tax-paying culture in citizens.

- Ensure transparency of the management of state resources and the means to dispose of them, by launching a publicly accessible electronic portal that includes all economic actors. In addition, data relating to their tax status should be highlighted to bring out the degree of compliance with their tax obligations. The Joint Commission for Financial Transparency of the Ministry of Finance should adopt this approach and define it as an annual target or as a performance index. However, it is crucial to guarantee its political and legal protection, which requires the intervention of the executive power and the establishment of the necessary legislative texts.

- Consolidate The Ministry of Finance’s general administration in the management of human resources by supporting the human capital and strengthening the technical and logistical arsenal of tax services.

- Accelerate the adoption of the unique identifier system. The initial inclusion and updating of taxpayers’ addresses in the tax identifier database would ensure the operations of notification, reporting and deduction. The General Directorate of Studies and Tax Legislation must coordinate with the tax legislation and service staff to guarantee the verification of updated data.

[1] biopolitics is a politico-philosophical term used by Michel Foucault in his courses at the Collège de France between 1977 and 1978 to designate all the institutions, mechanisms, studies, results, calculations and strategies deployed by a political power to impose its vision on a given social group (and not on individuals), in order to increase its human wealth (for example by increasing the rates of schooling, longevity and gross incomehttps://oxfordre.com/internationalstudies/view/10.1093/acrefore/9780190846626.001.0001/acrefore-9780190846626-e-80?rskey=xOGS6j [2] Different laws of finance: http://dev.finances.gov.tn/old/version2/index.php?option=com_jdownloads&view=viewcategory&catid=10&Itemid=428&lang=ar-AA[3] Jalel Hammami (2016) Rawafed, Issue 21, http://www.pist.tn/record/143385 , This telegram is also cited in Jean Ganiage (YEAR) The origins of the French protectorate.[4] http://ftusanet.org/wp-content/uploads/Projet-de-reforme-fiscale_FR.pdf [5] Flat-rate regime: tax regime reserved for sole proprietorships earning income in the category of industrial and commercial profits within a single establishment and meeting the following criteria: whose annual turnover does not exceed 100,000 dinars, no importers, not carrying out the activity of wholesale trade, not owning more than one public transport vehicle for people or for transporting goods with a payload not exceeding 3.5 tonnes, not subject to tax on value added according to the real regime and not having been subject to personal income tax according to the real regime following a tax audit. The beneficiaries of this regime, on the basis of transactions below or equivalent to 10,000 dinars, must pay 150 dinars per year for companies located in communal areas and 75 dinars per year for those outside. In addition, taxpayers whose transactions are estimated between 10 and 100,000 dinars must pay 3% of their transactions. Source: circular from the Ministry of Finance relating to the 2016 finance law [6] Abdejlil Bedoui (2014) “The Tunisian fiscal system and its role in establishing social justice”. Tunisian forum for Economic and Social rights. Available at https://cutt.ly/bnTTRPv [7] Abdejlil Bedoui (2014) “The Tunisian fiscal system and its role in establishing social justice”. Tunisian forum for Economic and Social rights. Available at https://cutt.ly/bnTTRPv [8] Ministry of Finance (2013) Available at http://dev.finances.gov.tn/old/version2/images/%D9%88%D8%A7%D9%82%D8%B9.pdf [9]Oxfam: Tax justice in Tunisia, a vaccine against austerity. Policy Paper. Available at https://www.oxfam.org/fr/publications/la-justice-fiscale-en-tunisie-un-vaccin-contre-lausterite[10]Malik Al-Khadrawimnia Bin Hammadi (2016) Liberal professions: tax fraud in Tunisia in figures. Inkyfada. Available at https://inkyfada.com/ar/2016/11/23/المهن-الحرة-التهرب-الجبائي-تونس [11] Sahar Mechmech (2020) “The tax administration in Tunisia: a dysfunctional apparatus”. Marsad. https://budget.marsad.tn/media/uploads/2020/12/28/the-tunisian-tax-administration-ar-1.pdf [12] see reference 11[13] Report 24 of the Court of Audit: http://www.courdescomptes.nat.tn/Ar/%D8%A5%D8%B5%D8%AF%D8%A7%D8%B1%D8%A7%D8%AA_59_3_10_0_0_1980_2021_eeeeeee-eeeeee-eeeeee-eeeeeeee_6Report 32: http://www.courdescomptes.nat.tn/Ar/%D8%A5%D8%B5%D8%AF%D8%A7%D8%B1%D8%A7%D8%AA_59_3_10_0_0_1980_2021_eeeeeee-eeeeee-eeeee-eeeeee-eeeeeeeee_62[14]see reference 11 [15]see reference 9 [16] see reference 6[17] Financial Secrecy Index 2020, Tax Justice Network : http://fsi.taxjustice.net/PDF/Tunisia.pdf[18] Recovery of State debts, Report 32 of the Court of Audit: http://www.courdescomptes.nat.tn/Ar/%D8%A7%D9%84%D9%82%D8%B7%D8%A7%D8%B9%D8%A7%D8%AA_58_4_-1_0_0_0000_0000_eeeeeee-eeeeee-eeeeeeee-eeeeeee-eeeeeee-eeeeee__290#[19] Tax Reform project: https://www.usaid.gov/sites/default/files/documents/1883/FIRST_Factsheet_082018_USAID.pdf[20] see reference 7 [21]1Fiscal Reform For A Strong Tunisia (FIRST), https://www.usaid.gov/sites/default/files/documents/1883/FIRST_Factsheet_082018_USAID.pdf, consulté le 11 avril 2021[22] Statement by former Minister of Finance Nizar Baich at the press conference on July 21, 2020 https://acharaa.com/%D8%A7%D9%84%D8%B1%D8%A6%D9%8A%D8%B3%D9%8A%D8%A9/%D9%85%D9%86%D9%87%D8%A7-%D8%A5%D9%84%D8%BA%D8%A7%D8%A1-%D8%A7%D9%84%D8%B9%D9%85%D9%84-%D8%A8%D8%A7%D9%84%D9%86%D8%B8%D8%A7%D9%85-%D8%A7%D9%84%D8%AA%D9%82%D8%AF%D9%8A%D8%B1%D9%8A-%D8%AA%D9%81%D8%A7/